2026 Budget and Tax Increase

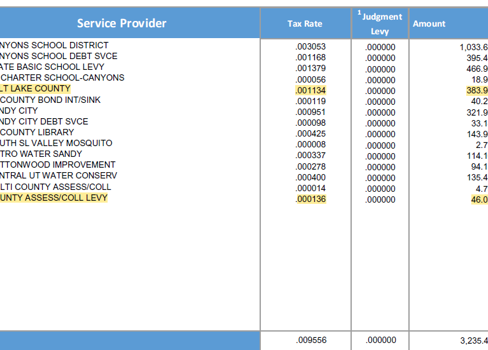

The 2026 Salt Lake County budget was passed with a property tax increase of approximately 14.65%, which equals less than $6.00 per month for the average homeowner (based on a $638,000 home value). The tax increase only applies to Salt Lake County's portion, which is about 17% of your total property tax bill. The remaining portions of property tax bills come from cities, school districts, and service districts that provide services like fire, water, and sewer.

For years, Salt Lake County has absorbed inflation by tightening budgets and finding efficiencies, yet costs have continually outpaced revenues. Like many Utah communities, Salt Lake County faces a structural gap that can no longer be ignored. The proposed increase is needed to help the County keep pace with rising costs while protecting essential services for our residents.